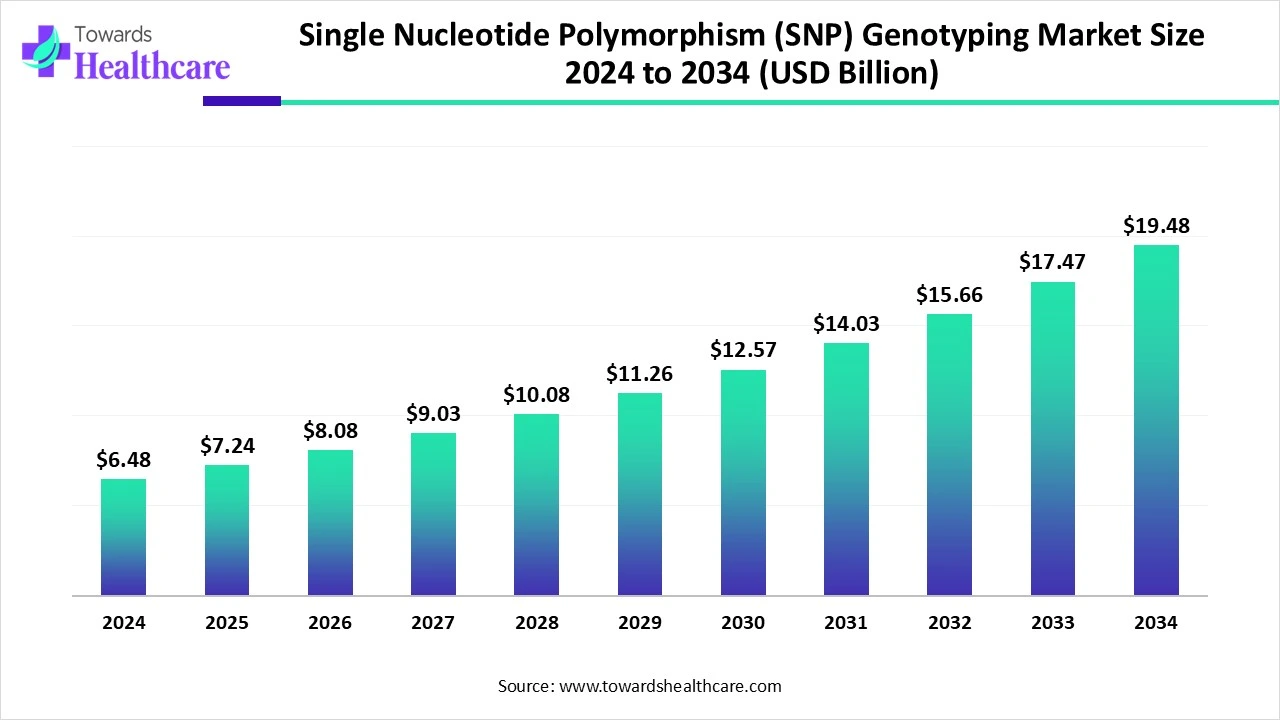

Decoding Our DNA: The Human Impact Behind SNP Genotyping’s USD 19.48 Billion Growth by 2034

The global single nucleotide polymorphism (SNP) genotyping market size was valued at USD 7.24 billion in 2025 and is predicted to hit around USD 19.48 billion by 2034, rising at a 11.7% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Feb. 13, 2026 (GLOBE NEWSWIRE) -- The global single nucleotide polymorphism (SNP) genotyping market size is calculated at USD 8.08 billion in 2026 and is expected to reach around USD 19.48 billion by 2034, growing at a CAGR of 11.7% for the forecasted period.

Download Free Customized Sample, Data and Insights as per Your Requirements: https://www.towardshealthcare.com/download-sample/5616

Key Takeaways

- North America accounted for the largest share of the single nucleotide polymorphism (SNP) genotyping market in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the studied years.

- By technology type, the PCR-based genotyping segment registered dominance in the market in 2024.

- By technology type, the sequencing-based genotyping segment is expected to grow at a notable CAGR in the studied years.

- By application type, the pharmacogenomics segment led the market in 2024.

- By application type, the genetic testing segment is expected to grow at the fastest CAGR in the studied years.

- By sample type, the DNA segment dominated the global market.

- By sample type, the RNA segment is expected to grow at a significant rate in the studied years.

- By end user, the pharmaceutical companies segment dominated the market in 2024

- By end user, the research labs segment is expected to grow at a notable CAGR in the studied years.

What is Single Nucleotide Polymorphism (SNP) Genotyping?

Single nucleotide polymorphism (SNP) genotyping is the process of identifying variation at a single DNA base position among individuals, helping to study genetic differences, disease risk, and drug response. The single nucleotide polymorphism (SNP) genotyping market is expanding due to increasing demand for personalized medicine, pharmacogenomics, and disease risk assessment. Advances in high-throughput sequencing and microarray technologies, coupled with growing research in genomics and biotechnology, are driving adoption. Rising investments in genetic research, early disease diagnosis, and precision therapeutics further boost the market, enabling more accurate and efficient identification og genetic variations across populations.

What are the Prominent Drivers in the Single Nucleotide Polymorphism (SNP) Genotyping Market?

Prominent drivers of the market include the growing focus on personalized medicine and pharmacogenomics, the increasing prevalence of genetic disorders, and the rising demand for early disease diagnosis. Technological advancements in high-throughput sequencing, microarrays, and bioinformatics tools enhance accuracy and efficiency. Additionally, expanding genomics research, government initiatives supporting genetic studies, and investments in precision medicine are fueling market growth globally.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What are the Substantial Trends in the Single Nucleotide Polymorphism (SNP) Genotyping Market?

- In May 2025, researchers from National Jewish Health, in collaboration with Advanced Diagnostic Laboratories, developed a molecular diagnostic test for Alpha-1 Antitrypsin Deficiency (AATD), a key genetic cause of COPD. Using a novel 23-SNP AAT assay, the test enables faster and more accurate detection of multiple genetic mutations linked to the disease, improving diagnosis and patient management.

- In April 2025, Baylor Genetics partnered with the Child Neurology Society (CNS) as their official genetic testing collaborator for 2025–2026. This partnership aims to provide comprehensive genetic testing for patients and families affected by epilepsy, neurodevelopmental disorders, and other neurological conditions, enhancing diagnosis and care.

What is the Emerging Challenge in the Single Nucleotide Polymorphism (SNP) Genotyping Market?

A key emerging challenge in the market is the high cost and complexity of advanced genotyping technologies, which can limit accessibility, especially in developing regions. Additionally, managing and analysing large-scale genomic data, ensuring data accuracy and addressing privacy and ethical concerns in genetic testing pose significant privacy and ethical concerns testing pose significant hurdies. Regulatory variation across regions further complicates market adoption and standardization of SNP genotyping solutions.

Regional Analysis

What Made North America Dominant in the Single Nucleotide Polymorphism (SNP) Genotyping Market in 2024?

In 2024, North America led the market due to its well-established facilities and advanced healthcare systems. High investment in biotechnology and genomic studiws widespread use of SNP genotyping in personalized medicine and drug development, and the presence of major biotech and pharmaceutical companies contributed to strong innovation and adoption, giving the region a clear advantage over other global markets.

In the U.S., the SNP genotyping market is expanding with strong adoption in precision medicine, clinical diagnostics, and genomics research, supported by advanced laboratory infrastructure and biotech investment. Current trends highlight the uptake of automation, AI-enabled analysis, and high-throughput sequencing, and future opportunities lie in broader clinical implementation and deeper integration with personalized healthcare and multi-omics platforms.

How did the Asia Pacific Expand At the Fastest Pace in the Market in 2024?

In 2024, the Asia Pacific region experienced the fastest growth in the Single nucleotide polymorphism (SNP) genotyping market due to rapid advancements in healthcare infrastructure, increasing investment in genomic research, and growing use of SNP genotyping in personalized medicine and diagnostics. Countries like China, India, and Japan expanded research facilities and laboratories, while government support and a large patient population helped accelerate technology adoption, driving strong market growth across the region.

In China, growth is propelled by significant investment in genomics research, government support, and expanding biotech and healthcare sectors. Trends include rising use of next-generation sequencing and genomic testing beyond research labs, and future opportunities exist in scaling population-wide genetic studies, cost-effective platforms, and expanding clinical and agricultural applications to meet local healthcare and innovation needs.

Curious about the latest in life sciences? We’ve got all the segmentation insights you need – Access the Annual Membership @ https://www.towardshealthcare.com/get-an-annual-membership

Segmental Insights

By Technology Type Analysis

How did the PCR-based Genotyping Segment Dominate the Single Nucleotide Polymorphism (SNP) Genotyping Market in 2024?

In 2024, the PCR-based genotyping segment led the SNP market due to its high accuracy, reliability, and cost-effectiveness. Its ability to quickly analyze genetic variations, compatibility with clinical and research laboratories, and widespread adoption in disease diagnostics, personalized medicine, and genetic studies strengthened its market position. The technology established infrastructure and ease of use made it the preferred choice for many applications globally.

The sequencing-based genotyping segment is expected to grow at a significant CAGR during the forecast period due to its ability to provide detailed, high-throughput genetic information. Increasing demand for precision medicine, advanced research, and large-scale genetic studies is driving adoption. Additionally, technological advancements in next-generation sequencing (NGS), cost reduction, and growing applications in disease diagnostics and personalized therapies are boosting market growth globally.

By Application Type Analysis

How did the Pharmacogenomics Segment Dominate the Single Nucleotide Polymorphism (SNP) Genotyping Market in 2024?

In 2024, the pharmacogenomics segment dominated the market due to the growing emphasis on personalized medicine and tailored drug therapies. Increasing awareness of genetic influence on drug response, rising prevalence of chronic diseases, and the adoption of SNP genotyping for optimizing drug efficacy and minimizing adverse effects strengthened its market position. Strong research activity and integration into clinical practice further boosted demand.

The genetic testing segment is expected to register the fastest CAGR during the forecast period due to rising demand for early disease detection, risk assessment, and preventive healthcare. Growing awareness of inherited disorders, increased adoption of direct-to-consumer testing, and expanding use of SNP genotyping in clinical diagnostics and personalized treatment planning are accelerating growth. Continuous advancements in testing technologies and improved affordability are further supporting rapid market expansion.

By Sample Type Analysis

Why the DNA Segment Dominated the Single Nucleotide Polymorphism (SNP) Genotyping Market?

The DNA segment dominated the market due to its high stability, accuracy, and suitability for large-scale genetic analysis. DNA samples enable precise detection of genetic variation and are widely compatible with advanced genotyping technologies such as PCR< microarrays, and sequencing. Their ease of storage, reproducibility, and sequencing. Their ease of storage, reproducibility, and blood application in clinical diagnostic pharmacogenomics and research further supported strong adoption.

The RNA segment is expected to grow at a significant rate during the studied period due to increasing focus on gene expression profiling and transcriptomics research. RNA-based SNP genotyping supports real-time analysis of functional genetic variation linked to disease progression and treatment response. Advancements in RNA sequencing technologies, growing applications in cancer research, and rising demand for precision medicine are further driving segment growth.

By End User Analysis

What Made Pharmaceutical Companies Segment Dominated in the Single Nucleotide Polymorphism (SNP) Genotyping Market in 2024?

The pharmaceutical companies segment dominated the SNP market in 2024, due to their extensive use of genetic data in drug discovery, clinical trials, and pharmacogenomics studies. SNP genotyping supports target identification, patient stratification, and therapy optimization, improving development efficiency. Strong R&D investments, expanding precision medicine pipelines, and increased focus on personalized treatments further reinforced the leading position of pharmaceutical companies.

The research labs segment is expected to grow at a notable CAGR during the studied years due to expanding genomics and population-based studies. Rising academic and government funding for genetic research, increasing use of SNP genotyping in disease association and biomarker discovery, and advancements in high-throughput genotyping platforms are driving adoption. Additionally, growing collaboration between research institutes and biotech companies is accelerating SNP-based research activities.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

What are the Recent Developments in the Single Nucleotide Polymorphism (SNP) Genotyping Market

- In May 2025, Regeneron acquired select assets of 23andMe for USD 256 million, strengthening its capabilities in genetics-driven drug discovery and research.

- In January 2025, Thermo Fisher reported Q4 2024 revenue of USD 11.40 billion and introduced the MagMAX Sequential DNA/RNA kit, designed to streamline DNA and RNA extraction for SNP genotyping workflows.

Key Players List

- Invivoscribe

- Veracyte

- Thermo Fisher Scientific

- 10X Genomics

- Myriad Genetics

- Illumina

- Nanostring Technologies

- QIAGEN

- Roche

- Oxford Nanopore Technologies

- Personalis

- Pacific Biosciences of California

- Invitae

- Bio-Rad Laboratories

- Agilent Technologies

Browse More Insights of Towards Healthcare:

The global oligonucleotide CDMO market size is calculated at US$ 2.55 in 2024, grew to US$ 3.11 billion in 2025, and is projected to reach around US$ 18.37 billion by 2034. The market is expanding at a CAGR of 21.83% between 2025 and 2034. The rise in next-generation sequencing for various genes-related research and study is driving the oligonucleotide CDMO market.

The global oligonucleotide synthesis market size is estimated at US$ 5.59 billion in 2024 and is projected to grow to US$ 20.31 billion by 2034, rising at a compound annual growth rate (CAGR) of 13.78% from 2024 to 2034.

The U.S. genotyping market size is projected to reach USD 26.53 billion by 2034, growing from USD 8.34 billion in 2025, at a CAGR of 13.72% during the forecast period from 2025 to 2034.

The global phosphoramidite market size is calculated at USD 1.29 billion in 2025, grew to USD 1.38 billion in 2026, and is projected to reach around USD 2.63 billion by 2035. The market is expanding at a CAGR of 7.4% between 2026 and 2035.

The AI in genomics market size is forecast to grow at a CAGR of 23.6%, from USD 1.67 billion in 2025 to USD 13.88 billion by 2035, over the forecast period from 2026 to 2035, as a result of growing cross-industry collaborations and increasing R&D.

The global biostimulants market size is calculated at US$ 3.53 billion in 2026, grew to US$ 3.29 billion in 2025, and is projected to reach around US$ 6.74 billion by 2035. The market is expanding at a CAGR of 7.44% between 2026 and 2035. To enhance crop production, the use of plant biostimulants is becoming common in the agricultural marketplace. These biostimulants can be used for multiple purposes, which in turn influences plant growth.

The global cell line development market size is calculated at US$ 6.44 billion in 2025, grew to US$ 7.07 billion in 2026, and is projected to reach around US$ 16.47 billion by 2035. The market is expanding at a CAGR of 9.85% between 2026 and 2035. New paths have been opened for cell line development (CLD) due to the increased availability of transcriptomic and genomic resources, which help to develop cell lines, coupled with advances in genome editing technology. This newly developed cell line helps in the manufacturing of biosimilars.

The global iPSC cell therapies market size was estimated at USD 10.44 billion in 2025 and is predicted to increase from USD 11.64 billion in 2026 to approximately USD 30.87 billion by 2035, expanding at a CAGR of 11.45% from 2026 to 2035.

The global biotechnology reagents & kits market size is calculated at USD 813.38 billion in 2025, grew to USD 902.36 billion in 2026, and is projected to reach around USD 2297.07 billion by 2035. The market is expanding at a CAGR of 10.94% between 2026 and 2035. The rising incidences of chronic disorders, increasing investments & collaborations, and growing research and development activities drive the market.

The global metabolomics market was evaluated at US$ 3.64 billion in 2025 and is expected to reach around US$ 12.84 billion by 2035, growing at a CAGR of 13.43% from 2024 to 2034.

Segments Covered in the Report

By Technology

- PCR-Based Genotyping

- Sequencing-Based Genotyping

- Chip-Based Genotyping

By Application

- Pharmacogenomics

- Genetic Testing

- Disease Diagnosis

- Forensic Science

By Sample Type

- DNA

- RNA

- Blood

- Saliva

By End User

- Research Labs

- Pharmaceutical Companies

- Clinical Laboratories

- Forensic Labs

By Region

- North America

- U.S.

- Canada

- Europe

- UK

- Germany

- France

- Italy

- Spain

- Denmark

- Sweden

- Norway

- Asia Pacific

- Japan

- China

- India

- South Korea

- Australia

- Thailand

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

- Kuwait

Make smarter decisions in genomics with our ready-to-use SNP Genotyping report@ https://www.towardshealthcare.com/checkout/5616

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Towards Packaging | Towards Food and Beverages | Towards Chemical and Materials | Towards Dental | Towards EV Solutions | Healthcare Webwire

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Check the Next Market Data and Insights:

https://www.towardshealthcare.com/insights/next-generation-sequencing-market-sizing

https://www.towardshealthcare.com/insights/synthetic-biology-market-sizing

https://www.towardshealthcare.com/insights/dna-sequencing-market-sizing

https://www.towardshealthcare.com/insights/biomarkers-market-sizing

https://www.towardshealthcare.com/insights/3d-cell-culture-market-sizing

https://www.towardshealthcare.com/insights/genome-editing-market-sizing

https://www.towardshealthcare.com/insights/genomics-market

https://www.towardshealthcare.com/insights/genomics-data-analysis-market-sizing

https://www.towardshealthcare.com/insights/genomics-life-science-analytics-market-sizing

https://www.towardshealthcare.com/insights/precision-medicine-market-sizing

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.